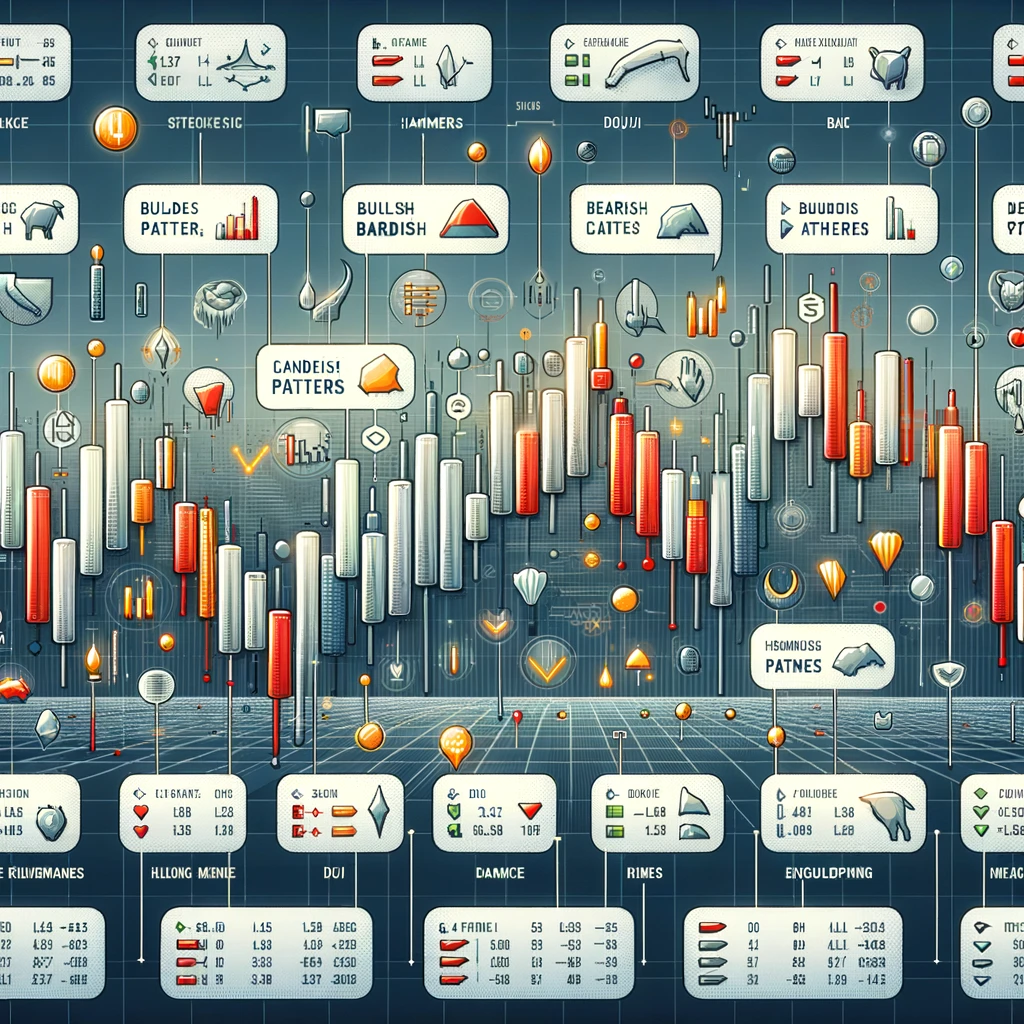

Candlestick Chart Guide

Understanding Candlestick Charts: A Guide for Beginners

What are Candlestick Charts?

For newcomers to crypto trading and investments, deciphering charts can be challenging. Some rely on intuition, but it doesn't always work, especially in the long term. This article will explain how to read and analyze candlestick charts to make more informed decisions in the market.

Candlestick Charts: An Overview

Candlestick charts are a tool for analyzing price movements in financial markets. They consist of candles, each representing price changes over a specific period of time.

History and Usage

Candlestick charts were created in the 17th century by Japanese rice trader Homma and have since become one of the primary tools of technical analysis. They help traders and investors understand price fluctuations and develop their own strategies.

Elements of a Candle

Each candle consists of an open, high, low, and close price for a specific period. These elements help determine the direction of price movement.

Reading Candlesticks

Candlestick charts make it easy to identify buyer and seller pressure in the market. The length of the candle's body and wick can provide clues about which forces controlled the market at a given time.

Advantages and Limitations

While candlestick charts provide a general overview of price changes, they may not always contain all the necessary information for comprehensive market analysis. They can also be subject to market noise on small timeframes.

Heikin-Ashi Candles: Smoothness and Reliability in Market Analysis

What are Heikin-Ashi Candles?

Heikin-Ashi candles, translated from Japanese as "average bar," are a special type of candlestick chart based on a modified formula that uses average price data. Their main goal is to smooth price movements and filter out market noise, making them an effective tool for identifying trends and potential reversal zones in the market.

Advantages and Usage

Traders often include Heikin-Ashi candles in their toolkit to more accurately identify market trends and avoid false signals. Green Heikin-Ashi candles without lower wicks usually indicate a strong uptrend, while red candles without upper wicks may suggest a strong downtrend.

Limitations and Summary

Despite their power, Heikin-Ashi candles have limitations. Because they average prices, they form more slowly than regular candles and do not show price gaps. However, when combined with other analysis methods, they can be a valuable tool for traders and investors.

Summary

Candlestick charts are a fundamental tool for traders and investors, providing flexibility and reliability in price analysis. Combining chart analysis with analytical thinking and experience can provide an edge in the market. However, for greater reliability, traders often turn to other analysis methods, such as fundamental analysis.